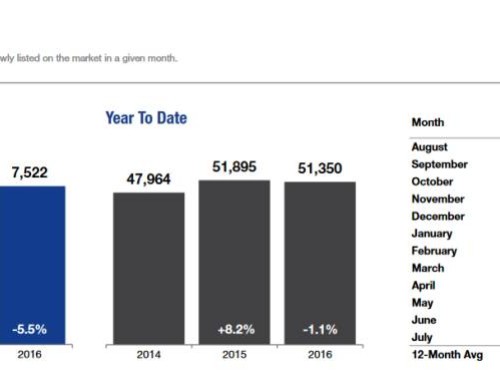

Minneapolis, Minnesota (June 12, 2013) – May was an impressive month for the 13-county Twin Cities residential real estate market. With 5,872 pending sales, buyer demand continued its ascent, surging 18.5 percent to its highest level since June 2005. Seller activity was also up, as new listings rose 26.2 percent to 8,332 units, representing the largest gain in new listings since January 2006 and the highest number since April 2010. Buyers have 14,375 properties to choose from – 22.3 percent fewer than in May 2012 but 11.6 percent more than in January 2013.

- New Listings: Highest Since April 2010

- Days on Market: Lowest Since January 2007

- Median Sales Price: Highest Since August 2008

The median sales price for the metro area rose 15.1 percent to $194,450. That’s the highest median sales price since August 2008. A shift in product type is driving this improvement. As recently as February 2011, foreclosures and short sales occupied 61.5% of all sales activity. In May 2013, these two distressed segments together comprised just 26.9 percent of all sales. The percentage of all new listings that were distressed in May 2013 fell to 18.6 percent, its lowest level since September 2007.

“With the recent disparity between massive buyer demand and sluggish seller supply, it is encouraging to see a substantial increase in traditional listings,” said Andy Fazendin, President of the Minneapolis Area Association of REALTORS® (MAAR).

Although new listings were up 26.2 percent overall, traditional new listings were up 49.9 percent, while foreclosure new listings were down 15.4 percent and short sale new listings were down 43.4 percent. With 15 straight months of year-over-year price gains, multiple-offer situations and just 3.4 months’ supply of inventory, the market landscape that once favored buyers has tilted toward sellers.

The traditional median sales price was up 7.3 percent to $220,000; the foreclosure median sales price was up 18.7 percent to $137,700; the short sale median sales price was up 4.4 percent to $141,000. On average, traditional homes sold in 78 days, foreclosures sold in 87 days and short sales lagged at 174 days.

“This is still about product mix. We once filled our grocery bag with ramen noodles,” said Emily Green, MAAR President-Elect. “Today we’re buying organic, grass-fed sirloin steaks. Grocery prices haven’t increased much, but the value of what we’re buying has. Traditional homes tend to be of a higher quality and better maintained than foreclosures or short sales.”

Click here to view the May 2013 Monthly Twin Cities Real Estate Indicators.

All information is according to the Minneapolis Area Association of REALTORS® (MAAR) based on data from NorthstarMLS. MAAR is the leading regional advocate and provider of information services and research on the real estate industry for brokers, real estate professionals and